nebraska property tax calculator

Today Nebraskas income tax rates. Nebraska school district property tax look-up.

Taxes And Spending In Nebraska

You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223.

. 0740 of Assessed Home Value. The tool helps residents calculate the new refundable income tax credit available this year that allows. Driver and Vehicle Records.

Registration Fees and Taxes. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The credit may be claimed by filing an Amended Nebraska Property Tax Incentive Act Credit Computation Form PTCX. Nebraska Income Tax Calculator 2021. California Property Tax Calculator - SmartAsset.

Nebraska property tax calculator get link. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. There are four tax brackets in. Its a progressive system which means that taxpayers who earn more pay higher taxes.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. AP Nebraska taxpayers who want to claim an income tax credit for some of. Counties in Nebraska collect an average of 176 of a propertys assesed fair.

For comparison the median home value in Nebraska is. Los Angeles County 1775. Nebraska Salary Tax Calculator for the Tax Year 202223.

For comparison the median home value in Lincoln County is. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Enter the amount of property taxes you paid in the.

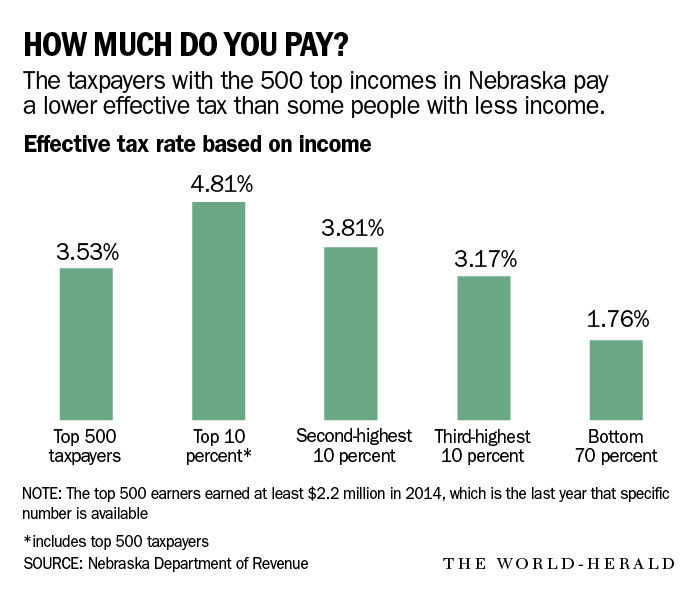

If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. Nebraskas state income tax system is similar to the federal system. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

Your average tax rate is 1198 and your marginal. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. The Nebraska tax calculator is updated for the 202223 tax year.

0710 of Assessed Home Value. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. Nebraska launches new site to calculate property tax refund.

File a 2020. Important note on the salary paycheck calculator.

Property Taxes Sink Farmland Owners The Pew Charitable Trusts

Property Tax Calculator Smartasset

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Papillion Looking At Lowest Tax Cut In Omaha Area News Channel Nebraska

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

U S Cities With The Highest Property Taxes

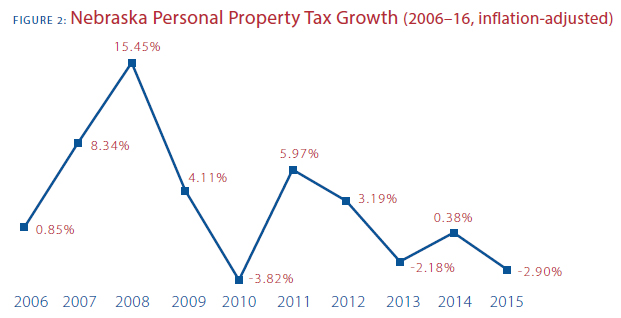

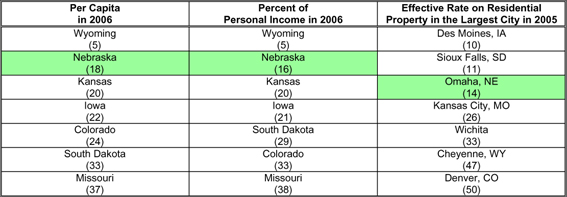

This Time It S Personal Nebraska S Personal Property Tax

Tax Calculator Chanute Ks Official Website

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Taxes And Spending In Nebraska

Nebraska Launches Online Property Tax Credit Calculator

Property Taxes By County Interactive Map Tax Foundation

Deducting Property Taxes H R Block

Nebraska Launches Online Property Tax Credit Calculator

Florida Property Tax H R Block

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom